Banking & Cashflow

Treasury tools to help you scale

Streamline and optimize cash flow for business growth.

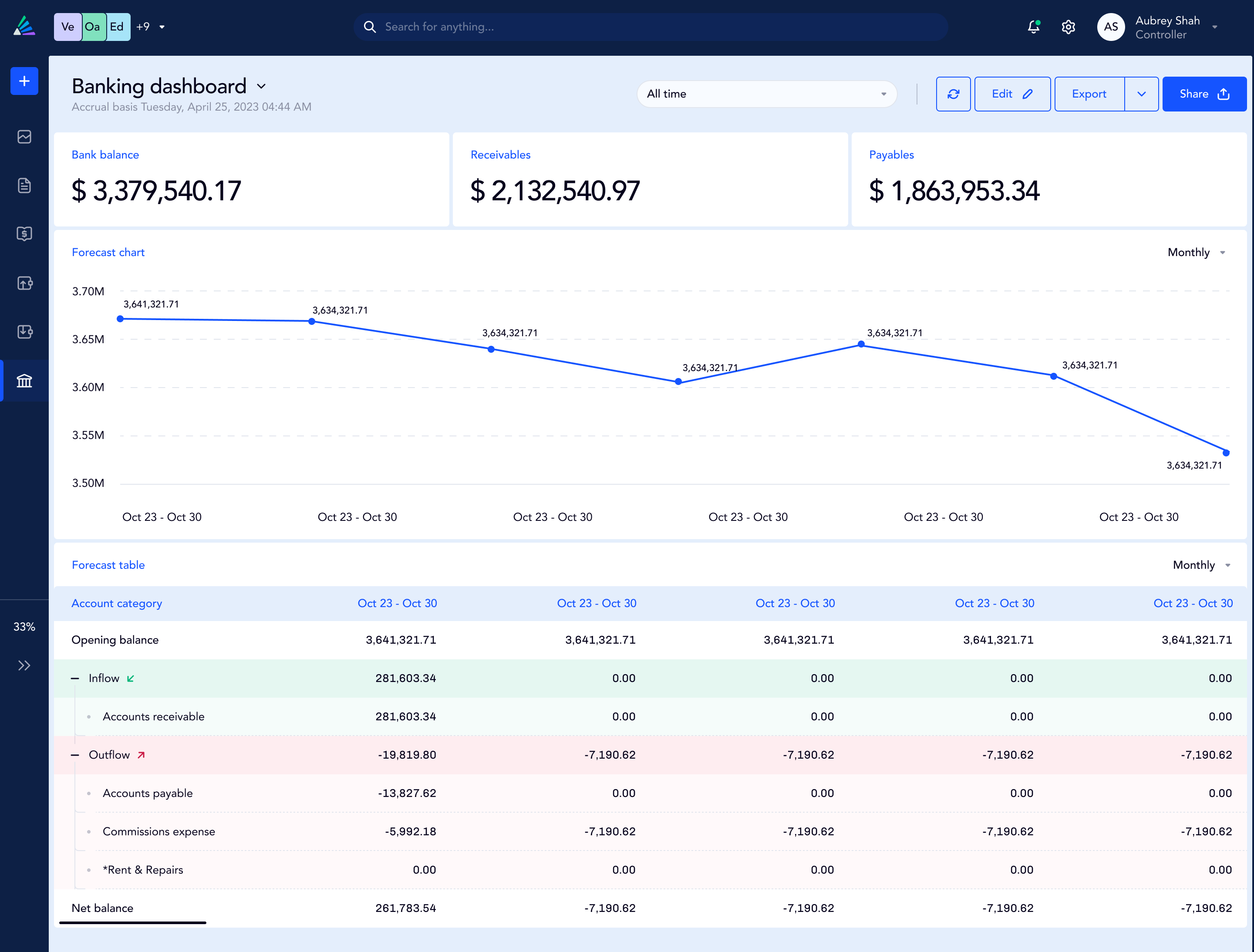

Manage treasury in real-time

Integrate with your banking apps to stay on top of your numbers at all times.

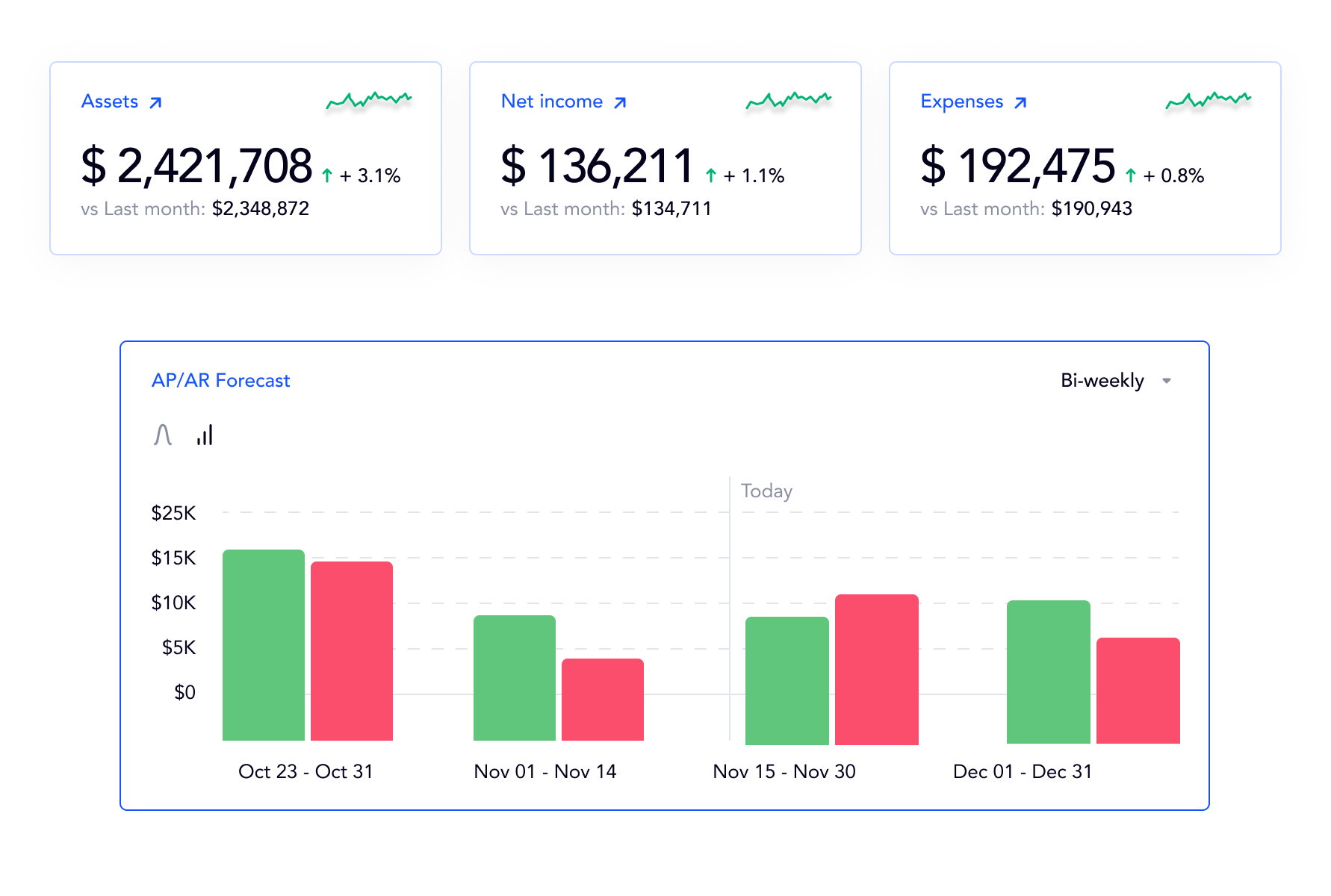

Gain precise cash flow insights

Strengthen your reserves and forecast accurately with integrated cash flow management tools.

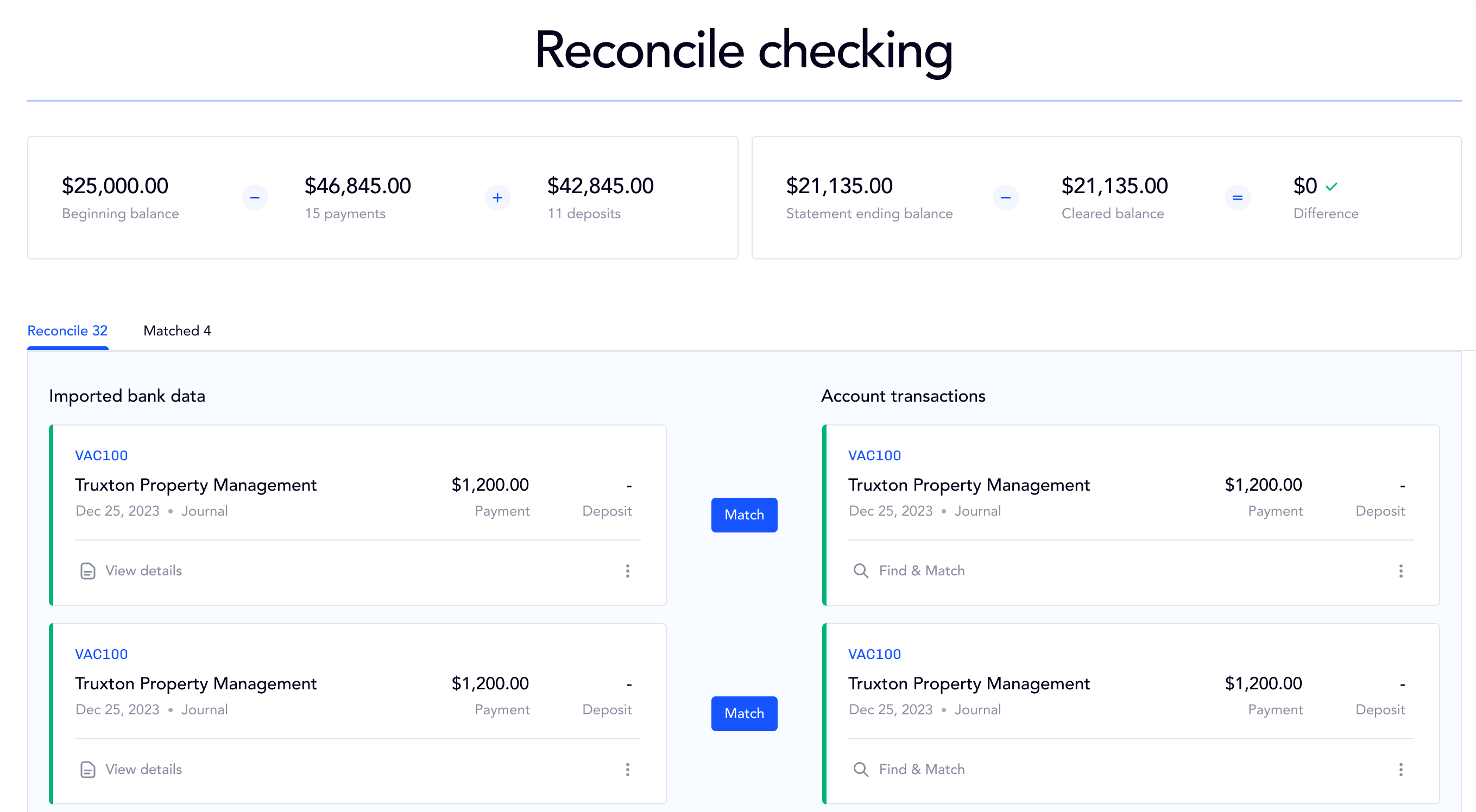

Eliminate errors in reconcilitations

Automatically reconcile transactions across every entity.

Optimize

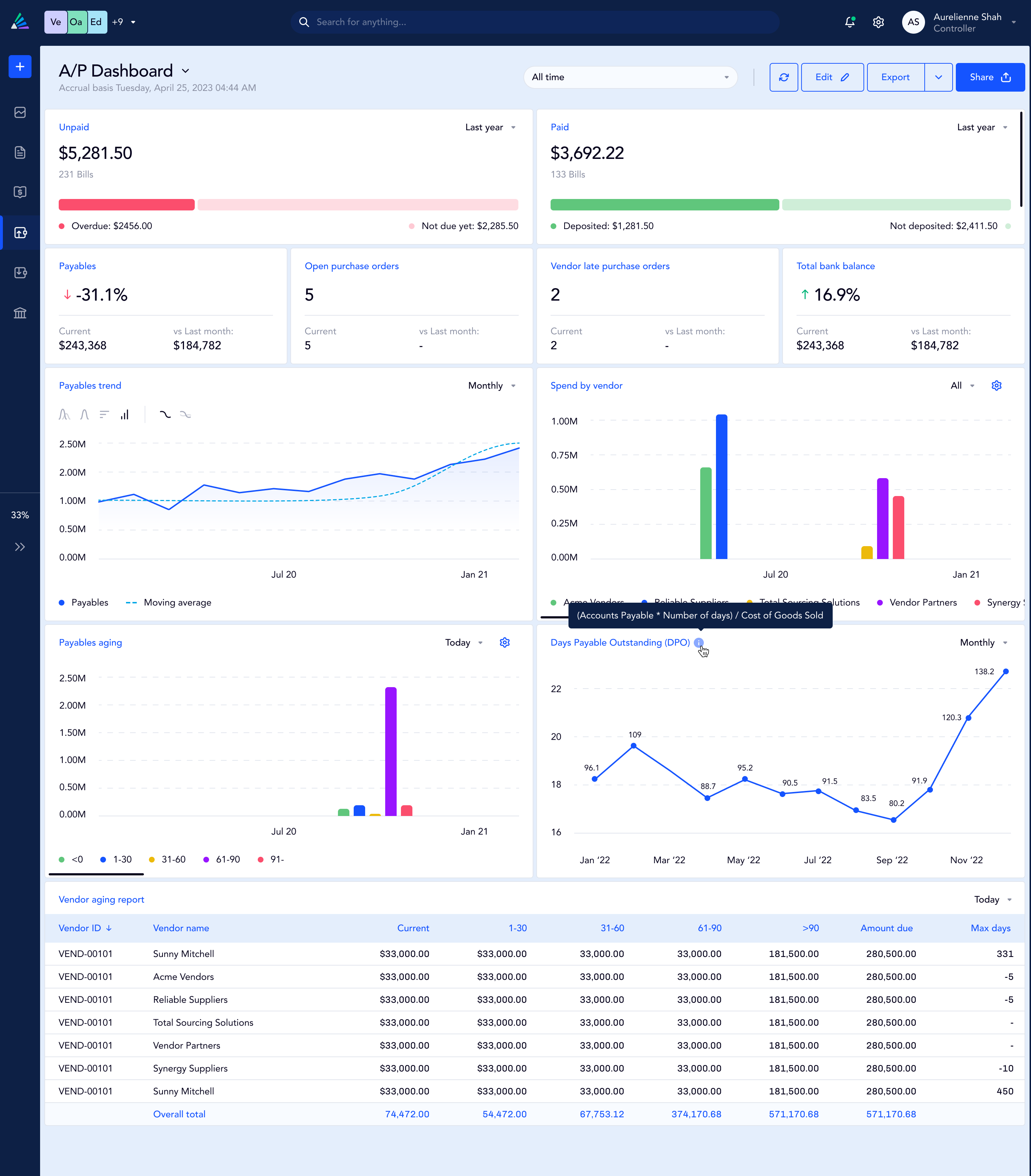

Track trends across invoices, due dates, and vendor payments

Stay ahead with accurate forecasts and models. Optimize cash flow by tracking trends in invoices, due dates, and vendor payments.

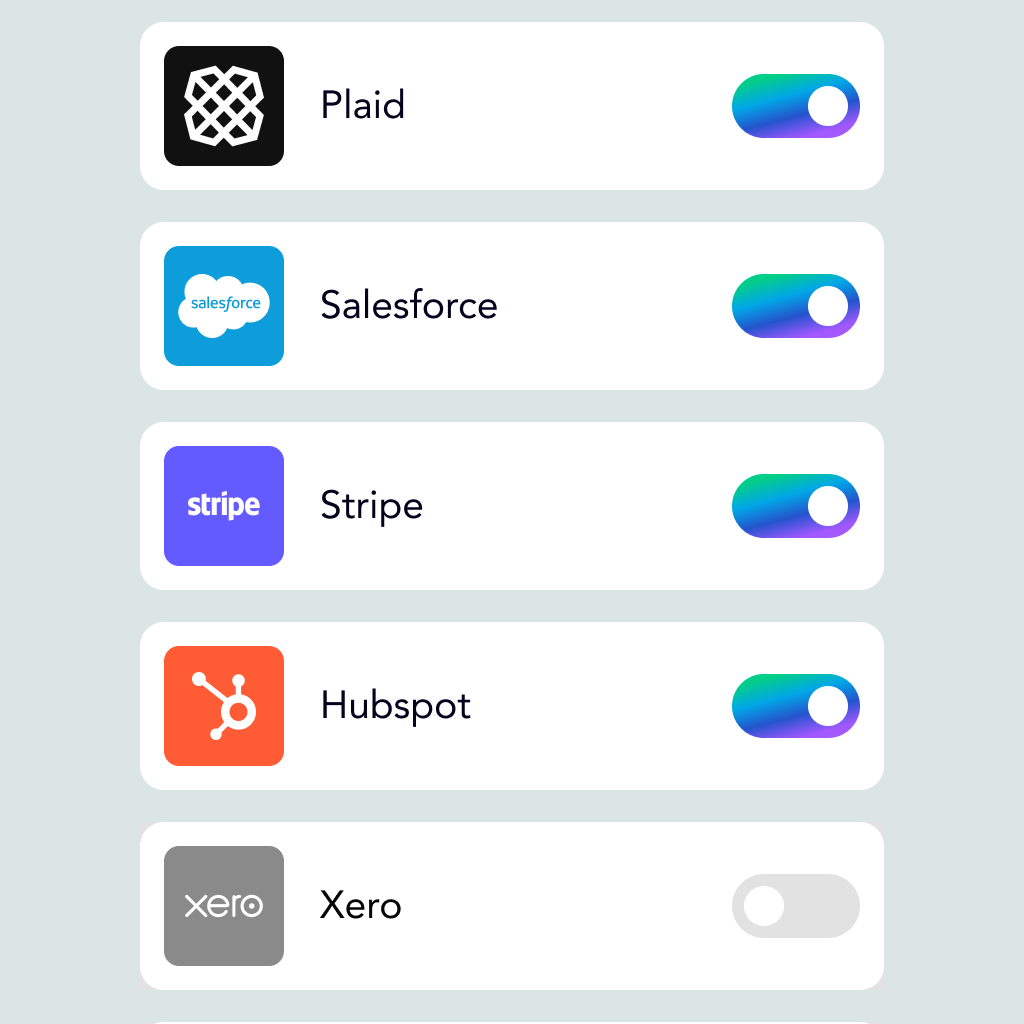

Integrate

Easily identify discrepancies

Automate bank reconciliations by integrating with your bank accounts, quickly identifying any discrepancies and minimizing errors.

Leverage custom dimensions to highlight the most relevant financial aspects for your business

Build custom tags and dimensions across your accounts.

Embed cashflow and tracking within Prismatic’s Intelligent GL

Integrate with a powerful suite of accounting and finance tools.

Integrate your family office data and achieve complete visibility

Addepar

Investments

Addepar empowers investment professionals across the globe with data, insights and cutting-edge technology.

Arch

Investments

Arch solves many of the problems facing active Investors / LPs: collecting K-1s; logging into the various web portals; and tracking performance, cash flows, and metrics across their investments.

Ramp

Spend Management

Ramp helps businesses control spend, save time, automate busywork & save an average of 5%.

Canoe

Investments

Canoe provides a scalable and automated solution that helps us to better collect and process unstructured investment data from multiple sources.

Charles Schwab

Investments

Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more.

Coinbase

Crypto

Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency.

J.P. Morgan

Investments

J.P. Morgan offers personal, commercial and investment products and is the largest bank in the world.

Aleta

Investments

A next-generation wealth management platform for forward-thinking family offices, uniting public, private, and alternative assets in an intuitive interface designed for fast adoption.

All partners

Addepar

Investments

Addepar empowers investment professionals across the globe with data, insights and cutting-edge technology.

Arch

Investments

Arch solves many of the problems facing active Investors / LPs: collecting K-1s; logging into the various web portals; and tracking performance, cash flows, and metrics across their investments.

Ramp

Spend Management

Ramp helps businesses control spend, save time, automate busywork & save an average of 5%.

Canoe

Investments

Canoe provides a scalable and automated solution that helps us to better collect and process unstructured investment data from multiple sources.

FAQ

Some frequently asked questions about our service.

Can Asseta replace QuickBooks for my family office?

Yes. Asseta is a purpose built family office general ledger platform designed to unify investments and accounting.

Asseta is built to replace QuickBooks for family offices that have outgrown single-entity accounting. Unlike QuickBooks, which was designed for small businesses, Asseta is a purpose-built general ledger and investment platform that handles the complexity of multi-entity, multi-currency family office operations.

With Asseta, you can:

- Integrate banking, investments, and accounting into one platform

- Consolidate across dozens of entities in real time

- Eliminate manual spreadsheets and workarounds

- Gain audit-ready books with family office–specific reporting

Can I build custom reports or dashboards?

Yes. Asseta includes a powerful custom reporting and dashboard builder. Users can create tailored financial reports using filters, custom groupings, calculated fields, and dimensional analysis themselves. Dashboards can combine multiple visualizations including tables, charts, and KPIs and be configured by role, entity, or user preference.

We also offer templates for common use cases like family office summary dashboards, GP/LP performance snapshots, and investment allocation breakdowns. Reports can be saved, scheduled, and shared with internal or external stakeholders.

Can I customize the chart of accounts?

Yes. Asseta provides a fully customizable chart of accounts to fit your entity structure, reporting needs, and financial workflows. You can add, edit, or deactivate accounts, create custom account types or subcategories, and structure the chart to match industry-specific standards such as for family offices, investment firms, or operating businesses. Changes are reflected in real time and can be managed across entities.

Can I export reports to Excel or PDF?

Absolutely. All reports in Asseta can be exported to Excel or PDF with a single click. Excel exports preserve formulas and formatting for further analysis, while PDFs are optimized for clean, professional presentation. You can also automate report distribution via scheduled exports to email or shared folders.

Can I import historical data?

Most family offices go live on Asseta within 8–12 weeks. The exact timeline depends on the state of your data, technology environment, and available resources.

From day one, Asseta’s team of CPAs, engineers, and customer success experts work alongside you ensuring a smooth migration, tailored configuration, and efficient onboarding so your team can realize value quickly.

Can dimensions be required or enforced on certain transactions?

Yes. You can configure specific dimensions to be required based on transaction type, entity, or account.

This ensures data consistency and prevents incomplete or miscategorized entries.

The system will prompt users to complete missing dimension fields before a transaction can be posted.

Can we allocate expenses across multiple entities/properties from a single bill?

Yes. Line items can be allocated across entities and dimensions (properties, family members, departments) with saved templates for recurring allocations.

Can we keep Bill.com or must we replace it?

You can do either. Asseta has a full AP module and a bi‑directional Bill.com integration so some firms keep Bill.com for payments and let Asseta own the GL.

Can we see real‑time cash positions and basic treasury across entities?

Yes. Dashboards can show consolidated and per‑entity cash, plus projected cash based on scheduled bills and known flows.

Can we see upcoming recurring bills and run what‑if scenarios?

Yes. Budgets and scheduled bills can be turned into forward‑looking cash reports; this is used primarily for treasury planning.

Can you drive cash‑flow forecasting off capital call histories in Arch/Canoe?

The near‑term approach is to surface historical call patterns and give clients tools to define assumptions, while being explicit that alt behavior is not fully predictable.

Can you get us off manual CSV uploads and hand‑typed bank transactions?

Yes. Most clients move from manual entry to automated feeds with categorization rules and occasional CSV uploads only for edge cases.

Can you track cost basis, realized/unrealized gains, and P&L by position?

For many clients, yes via integrated sources (Addepar, etc.); where you only have transaction streams, Asseta can compute gains/losses but isn’t yet a full portfolio accounting engine.

Do you offer implementation help for custom configurations?

Yes, we support custom configurations during onboarding and beyond. Whether you need tailored reporting, a unique chart of accounts, or integration mapping, our team works closely with you to ensure Asseta fits your specific needs.

Do you support ACH, check printing, and NACHA files?

Yes. Today Asseta generates NACHA files and supports in‑house check printing; direct ACH rails/virtual cards are on roadmap and some clients also keep Bill.com in the loop.

Do you support multi-dimensional accounting (e.g. by fund, family member, asset class)?

Yes. Asseta natively supports multi-dimensional accounting, giving you the flexibility to track and report on transactions across any dimension that matters to your family office.

You can tag transactions and balances by fund, entity, family member, asset class, investment vehicle, project, or custom dimension. This enables you to slice data in multiple ways, run consolidated or granular reports, and drill down for deeper insights all without manual spreadsheets.

With Asseta, your accounting reflects the true complexity of your portfolios, making analysis, reporting, and decision-making faster and more accurate.

Does Asseta integrate with Quickbooks?

Yes. Asseta integrates seamlessly with QuickBooks, in addition to many other financial tools. This integration allows for the smooth transfer of financial data from QuickBooks into Asseta, facilitating an upgrade path for businesses that need more robust features like multi-entity management and financial consolidation without losing their historical data.

Learn more about Asseta's integration partners.

How do you manage uncleared checks and outstanding payments?

Checks are tracked as open items; reconciliation workflows highlight outstanding payments versus cleared transactions.

How do your approval workflows work for bill pay?

Invoices can trigger multi‑tier approval chains based on amount, vendor, category, or entity, with auto‑approval thresholds for small recurring bills.

How does your invoice scanning work and what exactly does it extract?

Using Microsoft Vision AI, Asseta reads amounts, vendors, dates, terms and line items from PDFs/emails, creates draft bills, and then learns from user corrections. Invoices can be scanned in seconds and mapped to entities, dimensions and stored in Asseta's Document Vault.

How long does it take to implement Asseta?

Our average customer goes live within 8-12 weeks. The timeline depends on the state of your data, technology needs, and resource capacity. Asseta's team of CPAs, engineers, and customer success personnel will work directly with you to ensure an efficient implementation.

Is Asseta GAAP Compliant?

Yes, Asseta is GAAP compliant. We’ve built the platform to support the principles and requirements of GAAP, including features like accrual-based accounting, audit trails, dimensional chart of accounts, and proper revenue recognition workflows.

It’s important to note that compliance also depends on how the platform is used. No software can guarantee GAAP-compliant outcomes without proper oversight. It is ultimately the responsibility of the finance team, including controllers, accountants, and CFOs, to ensure their data and processes align with GAAP standards

Our role is to make that process easier, faster, and more reliable.

Is Asseta SOC II Compliant?

Yes, Asseta is SOC 2 Type II compliant. We undergo independent audits to ensure our controls meet the highest standards for security, availability, and confidentiality. This includes rigorous practices around data encryption, access controls, system monitoring, and operational processes. Our compliance demonstrates our commitment to protecting sensitive financial data and maintaining the trust of our clients.

Please visit our Trust Center to see our compliance status in real-time.

Is Asseta a general ledger?

Yes.

A general ledger forms the basis of a company's accounting system. It documents all company transactions, such as assets, liabilities, equity, revenues, and expenses. Every entry includes a debit and a credit, which must always balance to maintain accurate financial records.

The general ledger plays an integral role in producing financial statements. It helps businesses track their financial performance over time, allowing them to identify trends, manage budgets, and make informed financial decisions. The general ledger also assists in ensuring compliance with financial regulations and standards, as it provides a complete and accurate record of all financial transactions carried out by the company.

Is customer support included?

Yes, all customers receive dedicated support. Our team is available via Slack, email, and scheduled calls to assist with questions, troubleshooting, or ongoing guidance.

Response times are under 1-hour and we aim to get you the help you need as soon as possible.

What financial reports are included out of the box?

Asseta comes with a comprehensive library of pre-built financial reports designed for multi-entity, multi-asset environments.

These include:

- Consolidated and entity-level balance sheets and income statements

- Trial balances

- General ledger reports with full drill-down capabilities

- Variance and budget vs. actual analysis

- Reports by user-configured dimension, such as asset class, family member, or fund

All reports support dimensional filters, date ranges, and comparison periods, making it easy to get both high-level and granular views of financial performance.

What is the advantage of choosing Asseta?

Asseta is the only intelligent family office suite purpose-built to unify accounting, banking, and investments in one platform. Unlike generic software, Asseta is designed around the unique complexity of multi-entity, multi-asset family offices.

With Asseta, you gain:

- A modern general ledger built for family office scale

- Seamless integration across your existing systems

- Real-time visibility and reporting across every entity

- A platform that evolves quickly with the needs of the industry

By choosing Asseta, you’re equipping your family office with clarity, control, and a partner focused exclusively on your success.

Where is my data hosted?

Asseta is hosted on secure, enterprise-grade cloud infrastructure in the United States. We use AWS (Amazon Web Services) for its industry-leading security, reliability, and compliance capabilities. All data is encrypted in transit and at rest, with strict access controls in place to protect client information.

Which banks can you connect to and how reliable are the feeds?

Asseta connects to 15,000+ institutions globally via Plaid and other aggregators.

If a link breaks, it notifies you, reconnects, backfills ~2 years, and dedupes transactions.

We also offer direct bank feeds for certain banks not available via Plaid.

.png)

Chart of Accounts for Family Offices

Download our chart of accounts template for family offices, our #1 downloaded asset.